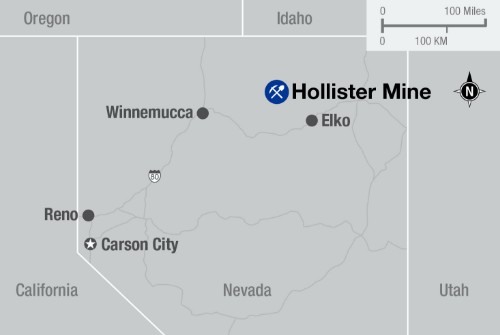

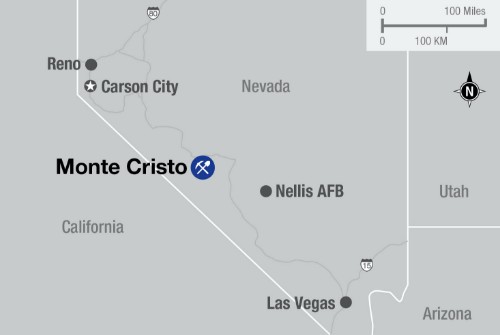

Nevada Portfolio

The Nevada portfolio (22% of exploration budget) is a high-impact development project – unlocking extraordinary value potential.

Nevada represents a transformative opportunity within Hecla’s portfolio, with multiple high-grade projects offering near-term production potential and district-scale discovery opportunities. Our renewed strategic focus leverages existing infrastructure, proven high-grade systems, and vastly underexplored targets.