Investors: 800.432.5291

Get the Latest

Subscribe here to receive Email Alerts about Hecla news, updates, events and more.

© 2026 Hecla Mining Company. All rights reserved

Hecla Mining Company stands apart from other mining companies because we are the largest U.S. and Canadian silver producer, operate two of the largest silver mines in the world that contain the highest-grade silver equivalent ounces, and we are also the oldest U.S. precious metals mining company.

Our business is to create value for our shareholders by discovering, acquiring, developing, producing, and marketing mineral resources at a profit. Our mission is to create long-term value for shareholders from mining silver, gold and associated base metals.

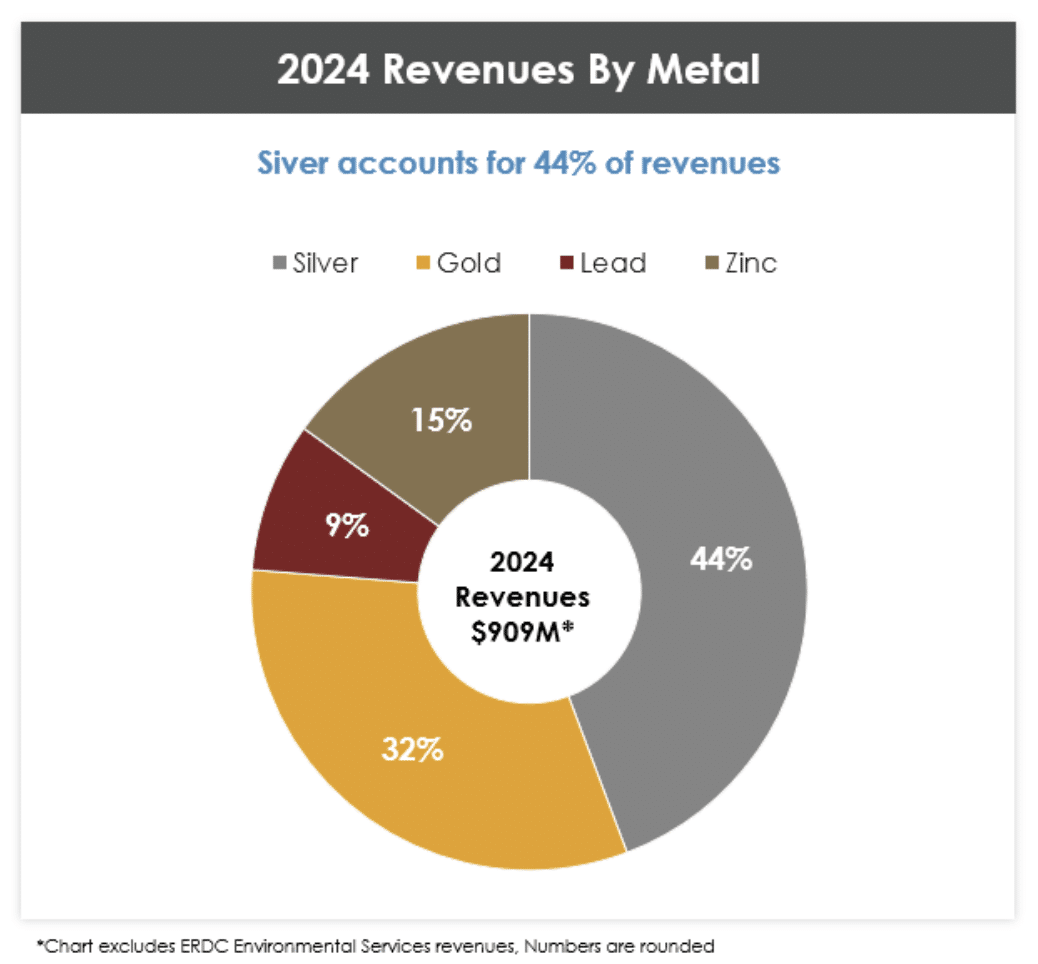

Hecla dominates U.S. and Canada’s silver production. We produce approximately 37% of all silver in the U.S. and 29% of all silver in Canada, and we also mine gold, lead, and zinc. Hecla owns the Keno Hill mine which has the largest primary silver reserves in Canada. Hecla has exploration properties in world-class silver and gold mining districts throughout North America.

|

Silver Production: 16.2 Moz Total Cost of Sales*: $487.6 M Cash Costs, after by-product credits *: $2.72/oz AISC, after by-product credits*: $13.06/oz Realized Price: $28.58/oz Gold Production: 142 Koz Lead Production: 52.5 Ktons Zinc Production: 66.3 Ktons *Reconciliations can be found on the Legal/Privacy page. |

Operating Mines

North American Countries

million ounces of silver reserves

million ounces of silver produced

exceeded 2024 production by over 5%

ounces of gold produced

tons of lead produced

tons of zinc produced

employees

contractors

billion in revenue

53% increase over prior year

*Free Cash Flow is a non-GAAP measure. A reconciliation of cash provided by operating activities (GAAP) to Free Cash Flow (non-GAAP) can be found on the Legal/Privacy page.

These are the characteristics that further differentiate us from our peers and will drive the value of the company now and into the future.

Market Position & Geographic Advantage

Asset Quality & Production Profile

Operational Excellence & Financial Strength

Sustainability & ESG Leadership

Growth Potential

Our Board of Directors is made up of five men and three women that bring diverse expertise, skills, professional experience, and industry background.

The Board oversees the Company’s business strategy with the goal of delivering long-term value to shareholders and stakeholders and monitors and assesses risk exposure.

Sustainability is integrated into Hecla’s business strategy, starting at the highest levels of leadership and planning. Our 2024 Sustainability Report details how our executive team and Board of Directors identify and manage environmental, social and governance (ESG) issues as well as how risks and opportunities factor into long-term planning.

The 2024 report is our eighth annual Sustainability Report. It was prepared with reference to the Global Reporting Initiative (GRI) 2021 Standards and maps to the Sustainability Accounting Standards Board (SASB) 2023 Metals and Mining Standard. For 2024, we are also disclosing using the Task Force on Climate-related Financial Disclosures (TCFD).

Learn more about Hecla in our Annual Report.

This website contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws, including Canadian securities laws. When a forward-looking statement expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, such statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by the forward-looking statements. Forward-looking statements often address our expected future business and financial performance and financial condition and often contain words such as “anticipate,” “intend,” “plan,” “will,” “could,” “would,” “estimate,” “should,” “expect,” “believe,” “project,” “target,” “indicative,” “preliminary,” “potential” and similar expressions. Forward-looking statements in this presentation may include, without limitation: (i) the Company will increase cash flow generation over the rest of the year; (ii) expected increase of the Company’s silver production to 15 million ounces by 2023; (iii) expected increase in Lucky Friday’s silver production to 5 million ounces by 2023; (iv) the new mining method being tested at Lucky Friday could improve safety and productivity at the mine beyond the 5 million ounces expected by 2023 due to grade; (v) Greens Creek estimates of full-year 2021 silver and gold production reaffirmed at 9.5 -10.2 million and 40-43 thousand, respectively, estimated 2021 cost of sales updated to $213 million, estimated cash costs, after by-product credits, and AISC, after by-product credits, each per silver ounce updated to $1.50 – $2.25 and $6.50 – $7.25, respectively; (vi) ability of business improvement activities at Casa Berardi to reduce costs and increase cash flow over the next two years; (vii) expectation of the Company to process 22,000 ore tons through the Midas mill and roughly 12,000 tons through a third-party roasting facility, and an additional 10,000 tons for processing at a third-party autoclave facility in the second half of the year with production in the range of 17,000 to 19,000 ounces of gold at the Nevada operations; and (viii) Company-wide estimates of future production, sales, costs of sales, cash costs, after by-product credits, AISC, after by-product credits, as well as estimated spending on capital, exploration and pre-development for 2021. The material factors or assumptions used to develop such forward-looking statements or forward-looking information include that the Company’s plans for development and production will proceed as expected and will not require revision as a result of risks or uncertainties, whether known, unknown or unanticipated, to which the Company’s operations are subject.

.

Estimates or expectations of future events or results are based upon certain assumptions, which may prove to be incorrect, which could cause actual results to differ from forward-looking statements. Such assumptions, include, but are not limited to: (i) there being no significant change to current geotechnical, metallurgical, hydrological and other physical conditions; (ii) permitting, development, operations and expansion of the Company’s projects being consistent with current expectations and mine plans; (iii) political/regulatory developments in any jurisdiction in which the Company operates being consistent with its current expectations; (iv) the exchange rate for the USD/CAD and USD/MXN, being approximately consistent with current levels; (v) certain price assumptions for gold, silver, lead and zinc; (vi) prices for key supplies being approximately consistent with current levels; (vii) the accuracy of our current mineral reserve and mineral resource estimates; (viii) the Company’s plans for development and production will proceed as expected and will not require revision as a result of risks or uncertainties, whether known, unknown or unanticipated; (ix) counterparties performing their obligations under hedging instruments and put option contracts; (x) sufficient workforce is available and trained to perform assigned tasks; (xi) weather patterns and rain/snowfall within normal seasonal ranges so as not to impact operations; (xii) relations with interested parties, including Native Americans, remain productive; (xiii) economic terms can be reached with third-party mill operators who have capacity to process our ore; (xiv) maintaining availability of water rights; (xv) factors do not arise that reduce available cash balances; and (xvi) there being no material increases in our current requirements to post or maintain reclamation and performance bonds or collateral related thereto.

In addition, material risks that could cause actual results to differ from forward-looking statements include, but are not limited to: (i) gold, silver and other metals price volatility; (ii) operating risks; (iii) currency fluctuations; (iv) increased production costs and variances in ore grade or recovery rates from those assumed in mining plans; (v) community relations; (vi) conflict resolution and outcome of projects or oppositions; (vii) litigation, political, regulatory, labor and environmental risks; (viii) exploration risks and results, including that mineral resources are not mineral reserves, they do not have demonstrated economic viability and there is no certainty that they can be upgraded to mineral reserves through continued exploration; (ix) the failure of counterparties to perform their obligations under hedging instruments; (x) we take a material impairment charge on our Nevada operations; (xi) we are unable to remain in compliance with all terms of the credit agreement in order to maintain continued access to the revolver, and (xii) we are unable to refinance the maturing senior notes. For a more detailed discussion of such risks and other factors, see the Company’s 2020 Form 10-K, filed on February 18, 2021, with the Securities and Exchange Commission (SEC), as well as the Company’s other SEC filings. The Company does not undertake any obligation to release publicly revisions to any “forward-looking statement,” including, without limitation, outlook, to reflect events or circumstances after the date of this news release or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement. Continued reliance on “forward-looking statements” is at investors’ own risk.

Qualified Person (QP) Pursuant to Canadian National Instrument 43-101

Kurt D. Allen, MSc., CPG, Director – Exploration of Hecla Limited and Keith Blair, MSc., CPG, Chief Geologist of Hecla Limited, who serve as a Qualified Person under National Instrument 43-101(“NI 43-101”), supervised the preparation of the scientific and technical information concerning Hecla’s mineral projects. Information regarding data verification, surveys and investigations, quality assurance program and quality control measures and a summary of analytical or testing procedures for the Greens Creek Mine are contained in a technical report titled “Technical Report for the Greens Creek Mine” effective date December 31, 2018, and for the Lucky Friday Mine are contained in a technical report titled “Technical Report for the Lucky Friday Mine Shoshone County, Idaho, USA” effective date April 2, 2014, for Casa Berardi are contained in a technical report titled “Technical Report on the mineral resource and mineral reserve estimate for Casa Berardi Mine, Northwestern Quebec, Canada” effective date December 31, 2018 (the “Casa Berardi Technical Report”), and for the San Sebastian Mine, Mexico, are contained in a technical report prepared for Hecla titled “Technical Report for the San Sebastian Ag-Au Property, Durango, Mexico” effective date September 8, 2015 . Also included in these four technical reports is a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant factors. Information regarding data verification, surveys and investigations, quality assurance program and quality control measures and a summary of sample, analytical or testing procedures for the Fire Creek Mine are contained in a technical report prepared for Klondex Mines, dated March 31, 2018; the Hollister Mine dated May 31, 2017, amended August 9, 2017; and the Midas Mine dated August 31, 2014, amended April 2, 2015. Copies of these technical reports are available under Hecla’s and Klondex’s profiles on SEDAR at www.sedar.com. Mr. Allen and Mr. Blair reviewed and verified information regarding drill sampling, data verification of all digitally collected data, drill surveys and specific gravity determinations relating to all the mines. The review encompassed quality assurance programs and quality control measures including analytical or testing practice, chain-of-custody procedures, sample storage procedures and included independent sample collection and analysis. This review found the information and procedures meet industry standards and are adequate for Mineral Resource and Mineral Reserve estimation and mine planning purposes.

Mr. Allen and Mr. Blair reviewed and verified information regarding drill sampling, data verification of all digitally collected data, drill surveys and specific gravity determinations relating to the Casa Berardi Mine. The review encompassed quality assurance programs and quality control measures including analytical or testing practice, chain-of-custody procedures, sample storage procedures and included independent sample collection and analysis. This review found the information and procedures meet industry standards and are adequate for Mineral Resource and Mineral Reserve estimation and mine planning purposes.